uber eats tax calculator canada

Taxes for Uber eats couriers Canada Hello everyone. Please try again later.

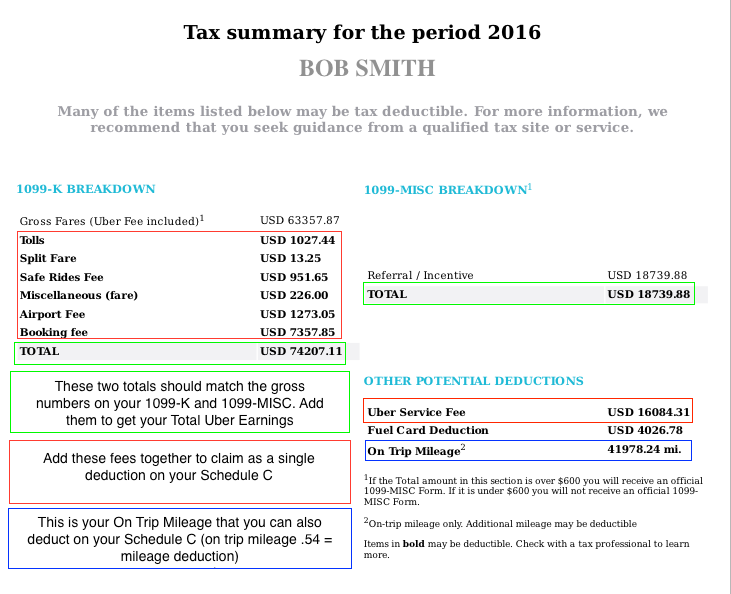

How Uber S Tax Calculation May Have Cost Drivers Hundreds Of Millions The New York Times

Receipts bills and statements for all tax deductible expenses.

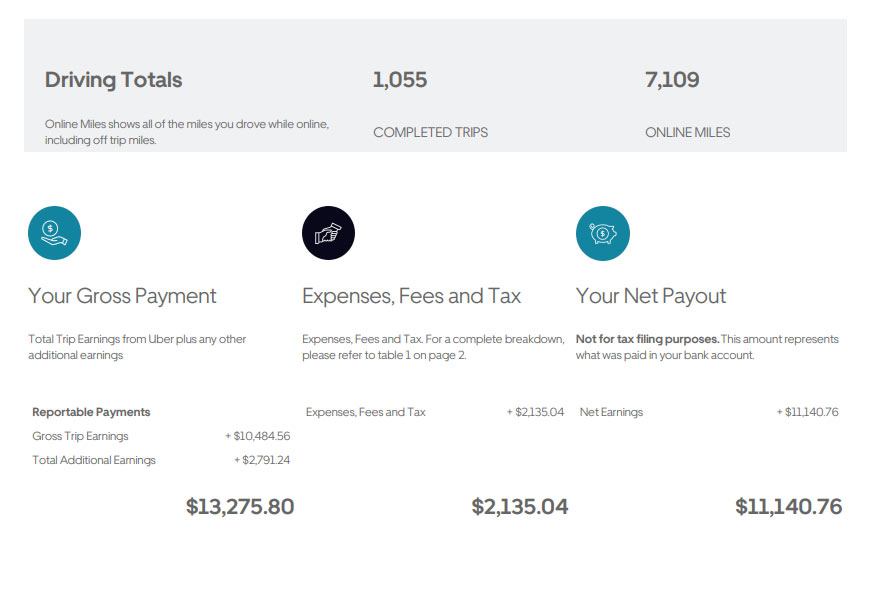

. You provided at least 200 rides or deliveries in the last year. You can claim a maximum of 30000 plus tax as the cost in the year. I worked for Uber delivering food over the summer and earned 7k roughly.

If you have a passenger vehicle or a motor vehicle that costs 30000 or less before taxes then use Class 10. Here are the rates. This method allows you to claim a maximum of 5000km at a set rate so your total deduction is quite limited.

Using our Uber driver tax calculator is easy. Many thanks in advance for your response. Uber Eats Canada Food Delivery and Takeout Order Online from.

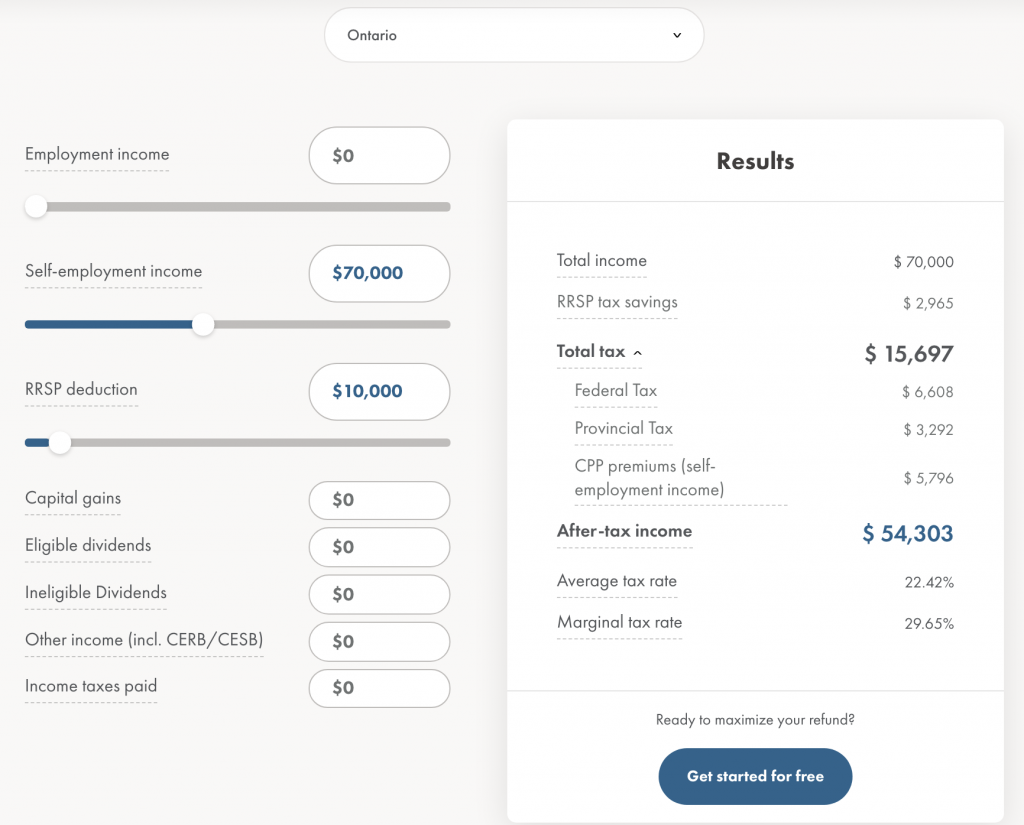

In Canada when you drive with Uber you are considered self-employed or an. Self-employed individuals are subject to specific tax filing documents. Well send you a 1099-K if.

The rate you will charge depends on different factors. Your vehicle mileage from the beginning of the. Your Annual Tax Summary from Uber found at.

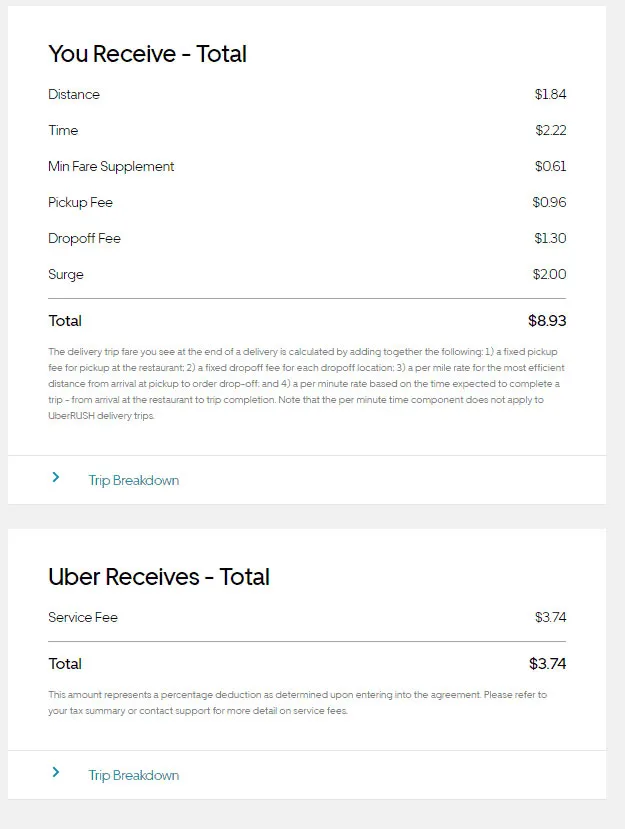

The list of income on the Uber sheet is before HST. When you drive with Uber income tax is not deducted from the earnings you made throughout the. If you put 10000 miles on your car thats a 5600 expense deduction you can claim on your taxes for the 2021 tax year.

In this video I had explained the uber eats tax process in canada. You earned more than 20000 in customer payments in the last year and. You simply take out 153 percent of your income and pay it towards this tax.

The following table provides the GST and HST. With so many people looking to hail a ride the Big Apples Uber drivers have the potential to make up to 3035 an hour. Driving Delivering - Uber Help.

But since this is my. Hi where can I input Uber Eats Tax Summary items such as On TripMileage when use BIKE no. For example if your taxable income after.

In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft. The rate is 72 cents per km so your. The following table provides the GST and HST provincial rates since July 1 2010.

There are many deductible expenses that Uber drivers are eligible to claim including mileage. I had shown various ways to claim your expenses and reduce your taxes. In other words it reduces your taxable Uber income.

Using our Uber driver tax calculator is easy. The Canada Revenue Agency CRA requires that you file income tax each year.

Uber Eats Driver Pay Calculator For Canada And Usa

Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Uber Eats Driver Pay Calculator For Canada And Usa

Money Management Lessons For Self Employed People

Do Uber Eats Uber Pay For Gas Ultimate 2022 Guide For Drivers

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

The Uber Eats Business Model 2022 Update Fourweekmba

Here S Everything You Need To Know At Tax Time If You Don T Work A Traditional 9 To 5 Narcity

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

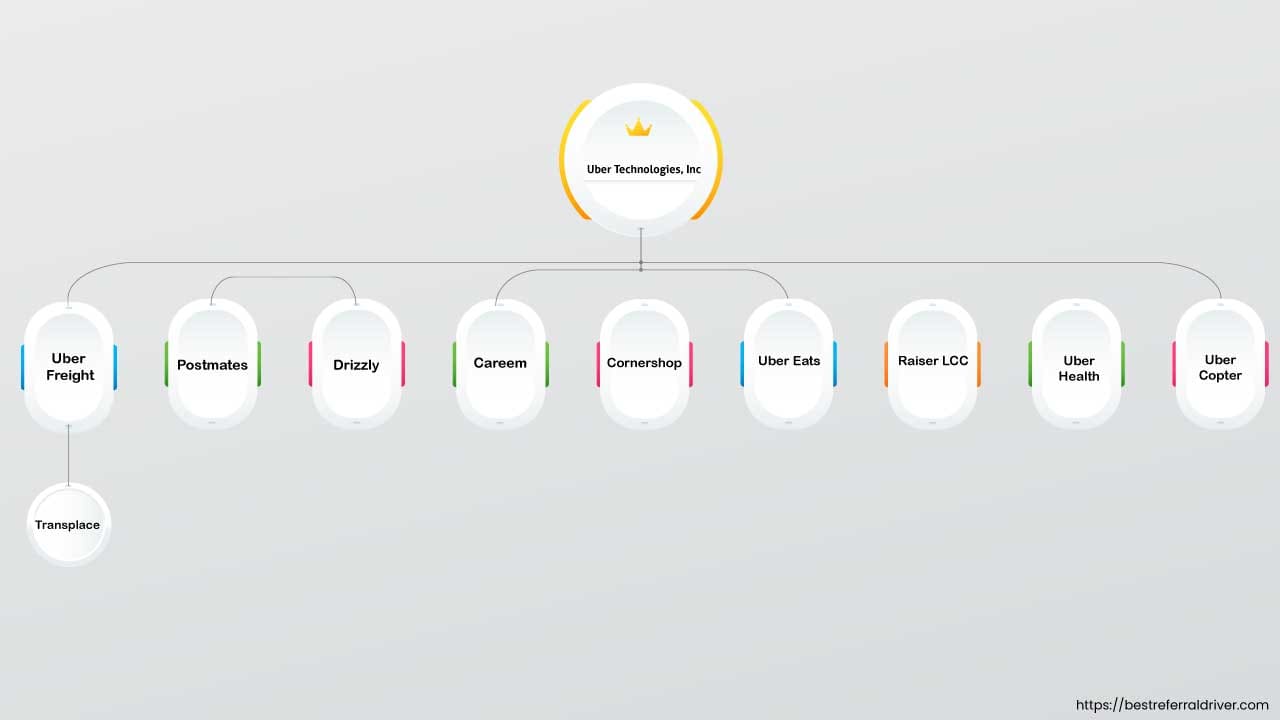

Uber Subsidiaries 11 Companies Owned By Uber Technologies

How Uber S Tax Calculation May Have Cost Drivers Hundreds Of Millions The New York Times

Uber Eats Driver Pay Calculator For Canada And Usa

Ubereats Tax Return Deductions Uber Drivers Forum

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog

Canada Revenue Agency Tax Tip Eight Things To Remember At Tax Time Lifestyles Thesuburban Com